Shatha Khalil *

The Arab region witnessed political , social and economic turmoil since 2011 called the Arab Spring; which led to the disruption of oil supply of many of the producing countries such as Libya, Syria and Yemen, as the market has lost about 1.6 million barrels per day of Libya ‘s high – quality light oil and OPEC can’t compensate the quantity, which led to the rise in oil prices since then above $ 100.

It continued to rise in 2012, as the United States and the European Union imposed a ban on the export of Iranian oil caused the exit of around one million barrels per day of oil from the market, exacerbating fears of an Iranian military response; kept oil prices high.

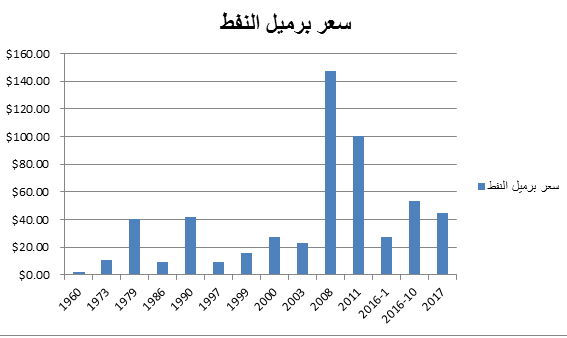

And the following chart, shows price fluctuations since 1960 until the first quarter of the year 2017: the price of a barrel of oil

We note on the chart large fluctuations in oil prices due to multiple causes in the eighties of the last century, caused by poor OPEC ‘s management of the market and the greed of the member states, in production and sales, as they did their best to keep prices at a high level with over-production; which created a surfeit of supply in the global market, It caused the decline in prices, and the increase in production of countries outside OPEC had a significant impact on the oil market also caused the decline in oil prices in addition to slowing of the growth of the global economy until the price reached to less than $ 10 per barrel, while some countries in OPEC to sell at $7.

Then prices saw a rise due to the Saudi agreement with OPEC to price protection, reducing the production of 17 million barrels per day to 15.8 million barrels to maintain a certain level of prices and avoid losses.

With regard to the future of oil prices, it can not be expected in the medium or long term, but marketing and crude oil specialists stress their concerns about the volatility of oil prices, and here it must be known the direct and indirect causes that manipulate with energy prices.

Crude oil prices are one of the most important indicators in the global economy, where governments and companies tend to spend a lot of time and effort to know where oil prices are heading.

If we want to simplify things it can be said that the forces of supply and demand are the factors affecting oil prices directly, like other goods and things in our daily lives, if the demand for it rises , its price will rise , and vice versa . If supply for it increases, the price falls, and the supply of crude oil is determined by the ability of oil companies to extract reserves from land and distributes it all over the world.

There are three main variables for the supply, namely: technological changes, environmental factors, and the ability of oil companies on the collection of the capital and renew it.

The main factors affecting the price:

• Increase the supply because of the technology improvements specially the hydraulic fracturing and horizontal drilling, which led to lower prices.

• The demand for oil is the most important controlling factors of oil prices globally, when the price rises , the demand falls , and vice versa, but in return when oil prices fall , the business investments related to it declines , such as: oil import operations, or industries that rely on oil derivatives such as the plastic industries , leading that the oil price be affected in the global economic markets, and the demand for oil tends to rise during good economic times and to decline during bad economic times.

- Organization of Petroleum Exporting Countries(OPEC), which consists of thirteen state directly affect oil prices; they have the ability to control prices by changing the rates of production, and the OPEC controls 40% of oil supplies in the world, representing 70% of world reserves.

- The production cost of the most important factors affecting the price, if we compare it between two different sources, we note that the cost of extracting oil in the Middle East are relatively cheap compared to other places such as Canada or the United States, and prices tend to rise as all cheap sources of oil are drained and only the most expensive sources are left.

- Indirect causes that affect prices significantly, are crises, natural disasters and political instability, Throughout history, periods of war have seen a substantial increase in demand for oil; and consumers to fear of economic deteriorating conditions, which in turn led to higher prices dramatically and the best example of this is the rise in oil prices, which reached US $ 147 per barrel in 2008, following the war developments at that time in Iraq and Afghanistan.

- Economic crises negatively affect the economy of a particular country or group of countries that the indebtedness rates are increased significantly, and less demand for oil with its price stability, or its rise, but countries cannot buy enough of it, then they are obliged to raise prices locally, so it can access to a close balance between the world and domestic price.

- Political crises affect , that usually occur in one state, on more than one country ; because of the existence of civil , or regional or international wars, leading to a negative impact on oil prices, and usually these crises lead to higher prices with increased demand on it by States .

- Alternative energy sources contributed to provide the human being with energy and it is an alternative for the use of oil which could affect its prices negatively in the long run , and this is clearly evident in many modern industries, which oil is no longer an essential part for it , but it has a minor role for it , and examples of these industries: the invention of electric cars, which rely on electricity as an energy source, with a small percentage of gasoline (a petroleum derivative); to assist in the operation.

- Booming of shale oil production in the United States, which has flooded markets with oil and it is likely that this is why OPEC countries, led by Saudi Arabia to keep the rate of fossil oil production at current levels without reducing it, resulting in a sharp decline in oil prices, and put more pressure on the shoulders of the American competitor, and the slowing of China’s economy of the factors that had a negative impact reflected on the global demand for oil.

It is noteworthy and influential heavily on oil prices is that there are ten countries that its oil is about to run out, which would take them in front of big problems in the future unless they discover other reserves to access to it or looking for alternatives.

And that countries such as China and India have not yet reached the peak of consumption of crude, and still per capita oil consumption rate is much lower than the rates of Western countries, but the gap is narrowing every year.

Economists predict that the contradiction between rising demand and falling prices will not last long, they see that when the market corrects the situation, dangerous repercussions will occur especially in countries where oil is running low (depleted).

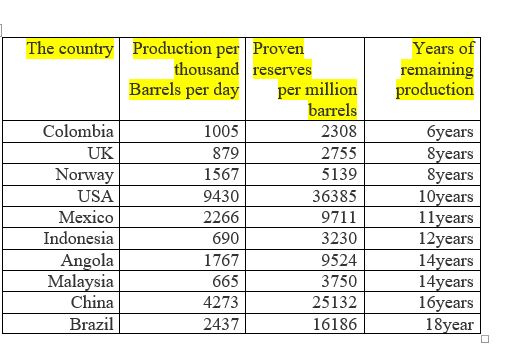

Adopted in this table on the annual statistical bulletin published by the Organization of the Petroleum Exporting Countries (OPEC), and here we note that even some countries that record large proportions in oil production, are threatened by the depletion of crude in the near future.

The economic expert Abdul Hai Zallum sees : The results or the political and economic implications of the disruption of oil prices lie in that the sudden decline and in the way that occurred in 2014 is an economic and political earthquake of heavy – caliber, which will have global consequences , especially in the oil – producing countries, in June 2014 the oil is sold at $ 115 a barrel, and the prevailing assumption that the price will remain higher than $ 100 and slowly increasing in the future.

Based on this assumption , energy companies have spent hundreds of millions of dollars in exploration and drilling operations on the high seas and extraction of sandstone oil in Canada, shale oil in the United States and heavy oil in Venezuela , noting that most of this type of production cost not less than $ 50 per barrel and today the price dropped less than $ 30 per barrel i.e it fell about 75% from the price of June 2014, making the so – called non – traditional production without economic feasibility, and the production will be stopped by the assistance programs for the production of so – called secondary and tertiary ways .

One of the reasons the United States has called for the resort to an economic seismicity:

– a drop in prices of this seismic form, which aims to “shake” the economy of rivals of the United States namely are: Russia, Venezuela and Iran, the target country is mainly the Russian economy and thus resulting in an earthquake and political goal.

– US and the global economy has not recovered from the financial crisis of 2008 and its results, and there is an economic slowdown in Europe and even in China there is a decline in prices that helps to stimulate those economies and the biggest loser here is the oil – producing countries.

Oil Prices Forecast 2021

the International Energy Agency assured consumers that the sharp decline in oil prices will not last and prices will resume rising dramatically by the year 2021. And said in a recent reports, it expects the recovery in oil prices before the end of this year.

And it suggests that the recovery will be followed by a sharp rise as a result of the decrease in the supply of oil producers due to the decline in investments in the sector who are suffering falling prices at the current time, as the price of Brent crude at its lowest level in the past 13 years at $ 28.88 a barrel.

The agency confirms the recovery of the price of crude a bit, but it’s still very much lower than the June 2014 levels when prices touched $ 115 a barrel, and Brent prices rose 4.9 percent to $ 34.62 a barrel.

The executive director of the International Energy Agency Fatih Birol said: “It is easy for consumers to be fooled by the large inventory and the low prices currently, but we should write on the wall: the historical decline of investments that we see now raises a lot of exclamation marks about the surprises that we may see on the oil security level in not too distant future.

On the other side, the World Bank predicted that crude oil prices this year to reach around $ 55 a barrel, instead of $ 53 a barrel with the readiness of the Organization of the Petroleum Exporting Countries OPEC members to reduce production after a long period of unrestrained production.

It is expected also that the prices of energy to jump including oil, natural gas and coal about 25% in total next year , 2018 , the biggest increase than expected in the month of July of the last year.

Consultant experts of the International Energy Agency expect that the supply of oil in the world markets to reach 4.1 million barrels per day in the period from 2015 and 2021, which indicates a decline compared to the world supply, which rose to 11 million barrels per day in the period from 2009 to 2015.

the experts pointed to the expectations of a decline of oil and production investments by 17% in 2016 after falling by 24% in 2016, and the international energy Agency emphasizes in its report that the current year 2017 will witness eventually the equality of supply with demand in the oil market, but the huge stocks that accumulate in the present time will weaken the pace of recovery of the prices in the market and when the market begins to restore the balance, then those stocks begin to dwindle.

The economic report issued by the Diplomatic Center for Strategic Studies indicates that there are several factors that will determine the price of oil in the future in 2018 , namely: the extent of growth in the global economy and thus the global oil demand growth , “but since the discoveries and new sources of conventional oil may be few , non – traditional oil will remain and the possibility of the spread of its extraction around the world is the main factor in determining global oil prices in the next ten years. ”

The report also refers to the difficulty of the possibility of knowing the future price trends without reference to the case of oil shale production, adding that some studies indicate that, by 2035, the rate of the shale oil production rate ranging between 10 to 14 million barrels per day, accounting for about 12% of the world’s total oil production.

It is noteworthy that there are expectations that oil prices will fall by 2025 to $ 97 a barrel due to the rise of supply from traditional and non – traditional sources explaining that some studies have indicated that the oil shale will lead to a decline in world oil prices that could reach $ 80 a barrel.

The report confirms that there is a divergence of views on the future of oil price expectations, but the price $ 80 a barrel remains the closest price to the average which is expected in the coming years.

Under the current circumstances, it is difficult to predict the level of oil prices with the continuation of international conflicts and internal problems in some oil -producing countries such as Libya, Nigeria, Iraq and Syria.

And the future oil prices will continue a hostage to the ability of the world to meet global oil demand growth, and remain governed by the extent of the balance between supply and demand for oil, the first energy source in the world.

Economic Unity

Rawabet Center for Research and Strategic Studies