By : Shatha Kalel

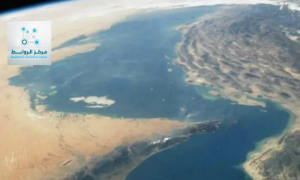

The Strait of Hormuz, a narrow waterway between Iran and Oman, is one of the world’s most strategically important maritime chokepoints. Roughly 20% of global oil—about 20 million barrels per day, according to the U.S. Energy Information Administration—passes through this strait. This equates to an annual trade value of $600 billion in oil shipments alone. Any disruption in this area could send shockwaves through the global economy.

Rising Tensions: A Real Possibility?

Following recent missile exchanges between Israel and Iran, concerns have grown that Tehran might respond by attempting to close the Strait of Hormuz. The commander of Iran’s navy has hinted that such action is under consideration. This possibility is being taken seriously by experts, including former MI6 chief Sir Alex Younger, who told the BBC that “closing the strait would undoubtedly pose a huge economic problem, given the impact on oil prices.”

An Iranian military speedboat was seen passing alongside a supertanker in the Strait on April 30, 2019, demonstrating Tehran’s continued naval presence and influence in the region.

1. Impact on Global Oil Prices

Any attempt to block or disrupt the Strait would likely cause oil prices to surge sharply, potentially exceeding $150 per barrel. The market is highly sensitive to tensions in the Gulf, and disruptions to this key route would create immediate supply insecurity.

2. Energy Crisis in Asia and Europe

Countries like India, China, Japan, and South Korea, which heavily rely on Gulf oil, would be significantly affected. Many would be forced to draw from emergency reserves or find alternative sources, usually at a much higher cost. Even nations not directly dependent on Gulf oil would feel the economic pressure due to global market reactions.

3. Global Economic Shock

Higher fuel costs would ripple through global economies, affecting transportation, manufacturing, and food prices. Developing countries would be especially vulnerable, with limited capacity to absorb or respond to such shocks.

4. Military and Political Consequences

A closure would likely trigger an international military response. The U.S. Fifth Fleet, based in Bahrain, along with NATO allies and Gulf states, would act to maintain freedom of navigation. Military escalation in this already volatile region could destabilize global markets and deepen geopolitical divisions.

5. Iran’s Strategic Gamble

While closing the strait could offer short-term political leverage, it would also harm Iran economically, as it relies on the same route for its own oil exports. A blockade could invite harsh international sanctions, isolation, and even military retaliation. The move, while dramatic, would be considered a last resort or extreme escalation tactic.

6. Alternative Routes and Mitigation

Some Gulf states have developed pipeline infrastructure to bypass the Strait, such as Saudi Arabia’s East-West Pipeline. However, these alternatives can only handle a fraction of the oil that moves through the Strait, which is just 40 kilometers wide at its narrowest point.

Conclusion

The Strait of Hormuz remains a critical artery of the global energy system. If Iran were to close it, the consequences would be immediate and severe: skyrocketing oil prices, supply disruptions, economic fallout, and potential military confrontation. The recent rise in tensions between Iran and Israel adds urgency to these concerns. While a full closure remains a worst-case scenario, the mere threat highlights the fragility of global energy security and the urgent need for diplomatic stability in the Gulf.

Economic Studies Unit / North America Office

Al-Rabetah Center for Strategic Research and Studies