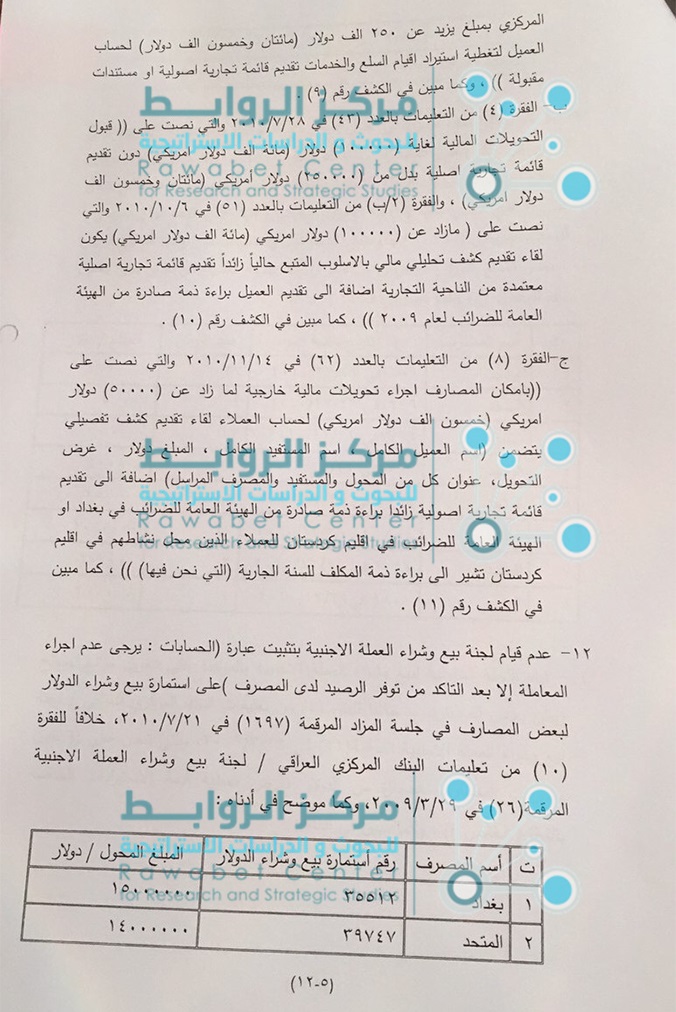

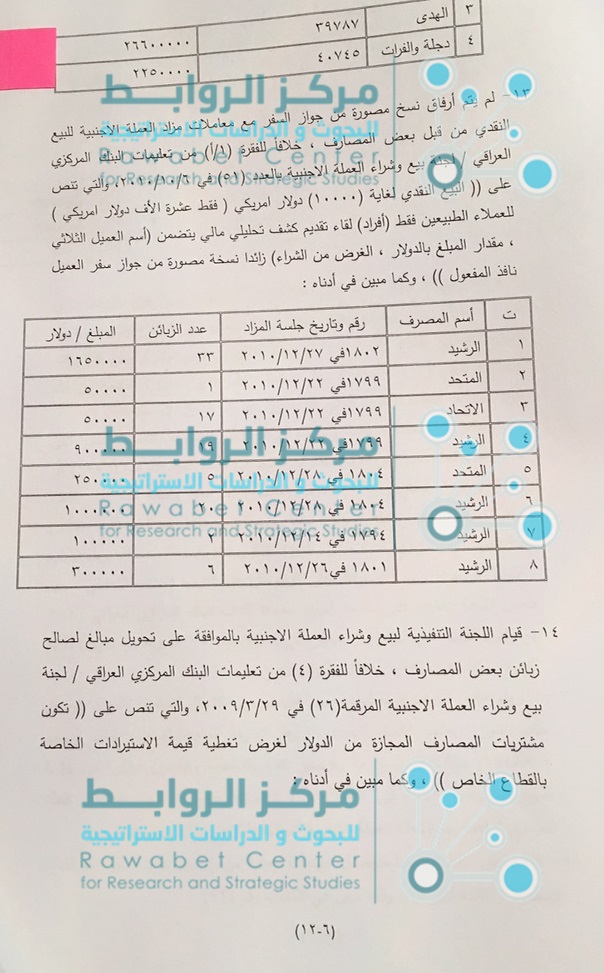

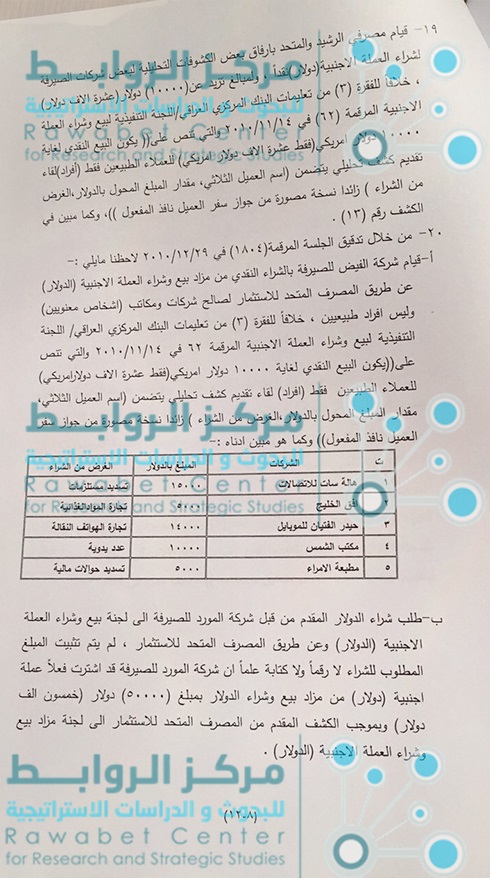

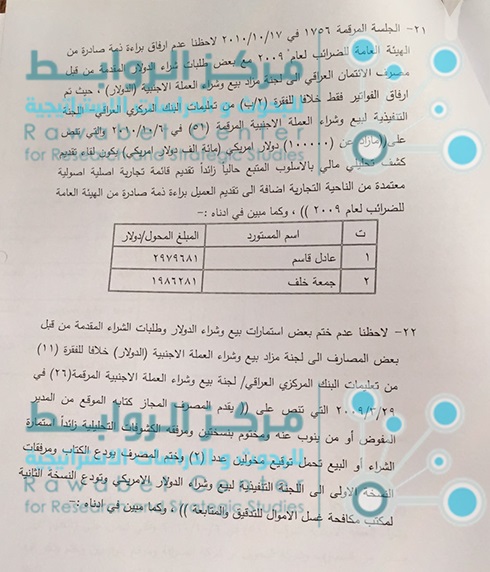

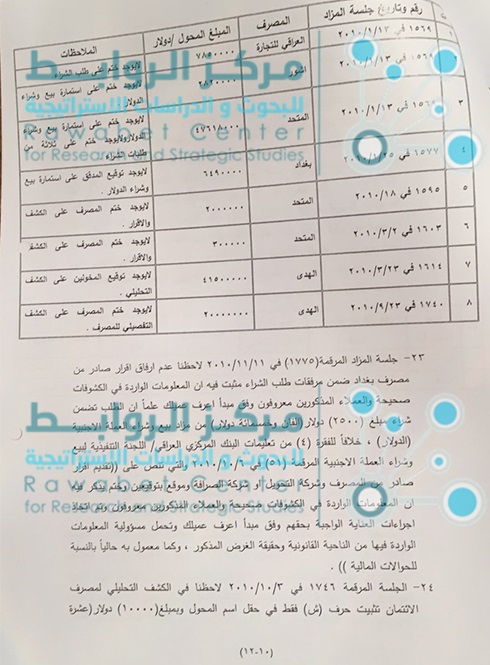

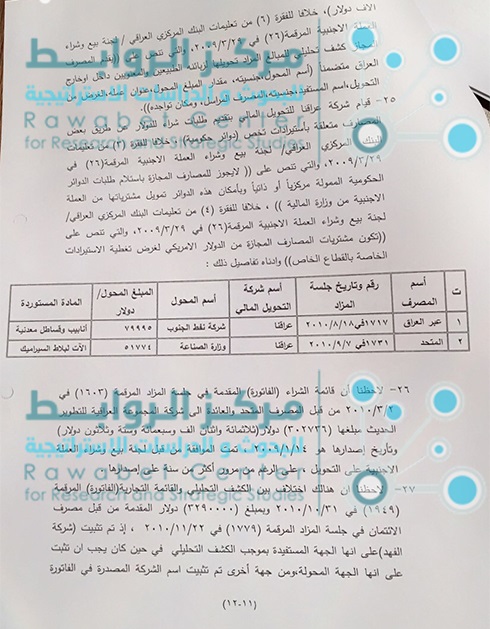

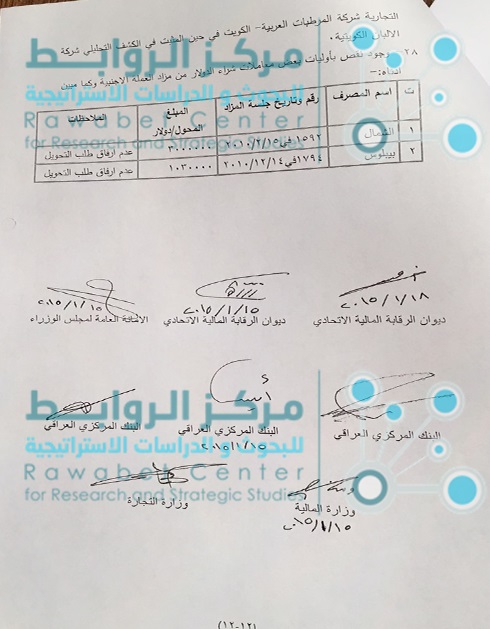

The “foreign currency auction”, which was created after the US occupation of Iraq in April 2003, specifically in the year 2004 by the Central Bank of Iraq, represents a new form of the economic corruption associated with the process of money laundering in Iraq and due to the importance of this issue and its negative impact on the exhausted Iraqi economy ,that Rawbet Center for Research and strategic Studies has obtained a new document with respect to auction of foreign currency in Iraq, issued by the Federal Office of control ” Office of audit the activity of financing and distribution,” that was sent to the General Secretariat of the Council of Ministers, ” the public Service commissions” and dated on the fourth of February 2015 m. Where the prevailing Subcommittee revealed on the results of audits of transactions, “the auction of foreign currency of the year 2010” in this document about the mechanism of corruption and fraud that were taking place in the auction of foreign currency in Iraq through observations such as, for example, that all forms of the buying and selling of the dollar and purchase orders with an auction sessions for buying and selling foreign currency are photocopies, not original, and also observed that some remittance companies, and companies of banking were buying dollar from auction of foreign currency through more than one bank for the same auction session. And also observed that the Executive Committee of the sale and purchase of foreign currency to approve the transfer of funds for the benefit of customers of some banks, contrary to paragraph “4” from the Iraqi Central Bank’s instructions. And observed not to attach a commercial, regular list by North Bank related to the customer, “Hussein Salim Hussein.” And many other observations that reveal the state of corruption in the financial sector in Iraq.

Surprisingly, of the corrupt who are looting the capabilities of the Iraqi people, that they are themselves on the forefront of public affairs of Iraq and speak “sincerely” for the concerns of the Iraqi people and the aspirations of his youth and his problems and propose the necessary solutions to solve it , they are well aware that they are an integral part of the tragedies of the Iraqi people, noting that these financial parasites would not become financial empires in Iraq if there was not a fertile environment for the financial and administrative corruption in Iraq after the ninth of April 2003. Since founding of modern Iraq, starting with the monarchy of “King Faisal I and King Ghazi, the King Faisal II,” which lasted until 1958, and through the republican system, “President Abdul Karim Kassem, President Abdul Salam Arif and his brother Abdul Rahman Arif, President Ahmed Hassan al-Bakr, and President Saddam Hussein” Iraq has not seen the phenomenon of corrupted financial empires , as seen in Iraq after the US occupation of it.

The former head of Iraq’s Commission on Public Integrity, Moussa Faraj, said that corruption leaders are politicians and Senior government officials, and this corruption was on the forefront of the reasons that led to the fall of one-third of Iraq to the hands of Daesh, and politicians have reduced the Iraqi people with the components , and the component with parties, and the Party with the closest to them , and the closest with the entourage . Iraq today can not be rescued by reforms, even if they exist, because the basis of any real reforms must begin with the trial of whales of corruption and recover Iraqi stolen funds that made the corrupted heads wealthy. No hope of saving the rest of Iraq, but a purge of these corrupted heads. and because the rawabet center is always seeking for the accuracy of the information provided to the reader that it puts to his hands this document issued by the Office of Federal Financial Supervisory which is as follows:

According to the documents, there are a number of banks still dominant on the currency auction in Iraq, including the Middle East Bank and alhuda bank and Trans Iraq Bank for investment and the Dijla and Furat Bank and Ashur international Bank, and some banking companies registered by the names of other people, but in fact affiliated to the same owners of banks previously mentioned and in spite of reports of office of financial Supervision(Federal Board of Supreme Audit) , no any legal action was taken against them and it should at least stop the work of these banks which violated the regulations of the Central Bank in order to reduce the phenomenon of money laundering.

Rawabet Center for Research and Strategic Studies