Shatha Khalil *

The budget is the government program of the Iraqi state, and its assessment depends on the economic reality of the country, and through which it is possible to know the extent to achieve the desired objectives to reform the deteriorating economic reality , and whether it achieved economic development or not ?

Among the main indicators of the Iraqi economy:

• Public debt and cash reserves, as the public debt has increased since 2013, rising from (73.1) billion dollars to (132.6) billion dollars in 2018, while the cash reserve has decreased from 77.8 billion dollars in 2013 to reach $ 40.8 billion in 2018.

• GDP, according to statistics from the Ministry of Planning, the proportion of oil contribution in its composition decreased after 2013, but this is not a positive indicator because this decline was due to the fall in oil prices only.

When reviewing the budget of 2017, we see that the revenues achieved were less than planned, totaling a total of 79,011 trillion dinars, while actually achieved only 75,030 trillion dinars, and this applies to the budget of 2018, unless there is a qualitative change in the implementation, Preliminary figures show that the total revenue is 90,982 trillion dinars, while the total expenditure to 103,997 trillion dinars. This means that the total planned deficit is 13 trillion Iraqi dinars, and is directed by the government to fill the deficit towards domestic or external borrowing; to meet the operational expenses and not limited to investments, contrary to economic rules.

The poor financial management and the preparation of the budget is subject to the repercussions of the political process, and building the public budget depends mainly on the revenues of oil resources, which suffer fluctuations in the volume of exports and prices, as for the high oil prices, it does not mean reducing the deficit, the fact is that the higher the price of oil , the greater the public spending .

In addition, there are problems in the oil wealth embodied in dealing with public money and non-spending according to the economic feasibility, which turned the Iraqi economy into a social welfare economy, and the absence of vision to invest the wealth of generations “oil” for the present and future , it is a depleted wealth and its use must be exclusively for the development of economic capital represented by bringing factories and the necessary technologies and human capacity building, and the development of a strategy to determine the rate of increase in the use of oil revenues for the purposes of investment allocations for the development of the economy of the country.

Poor non-oil revenues:

1. Actual non-oil revenues did not exceed 9% of public revenues.

2 – This ratio, with its moderation, depends on oil revenues by a large percentage. The taxes are mostly due to income taxes realized by the owners as a result of contracts and work with government departments (which in turn depend on oil).

3 – Mismanagement of the tax, the Iraqi tax system is one of the worst systems that waste large amounts of money, and tax revenues recorded less than its real value, and the fact indicates that there is a tax evasion estimated

(61%).

The lack of transparency in the planning and preparation of the budget, and the non-activation of the law allows the spread of financial and administrative corruption and in turn increases poverty in the country, which is clearly reflected on the economic reforms of Iraqi society.

Corruption in appointments

The mechanism of appointments in Iraq depends on partisan, nepotism and sectarian bases, which weakened the labor force base and thus the corruption destroyed scientific competencies and practical skills and replaced them by the inefficient ones , which eliminated the economic development in the country. The appointments are subject to party control, especially within the Iraqi security services, And the exclusion of some components is made , and each ministry, and each entity became the monopoly of one component without another.

The MP of the “coalition of Iraqi forces Liqa Wardi criticized,” , “the ambiguity surrounding the appointments in the security institutions.

she stresses that “she has sent official books demanding to explain the mechanism that followed the appointments and positions, and the share of each province and the town, but did not get a response,” noting that this strengthens the information that there are irregularities in the mechanism of appointment and positions, and the process of balance on the basis of provinces, which aims to build institutions on the basis of citizenship and balance between the components of the Iraqi people, without discrimination or exclusion, as stipulated by the Iraqi constitution.

she added “This reinforces sectarian discrimination and deprives the people of the affected provinces of their right to participate in the building of security institutions, in accordance with the principles laid down in the constitution,” .

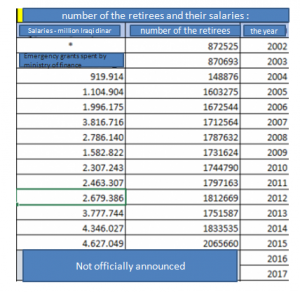

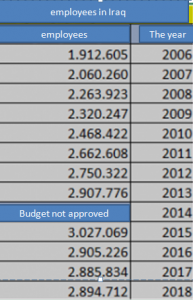

In the same context, a survey of the researcher Mohammed Al-Atabi, supported by two tables on the preparation of employees and retirees shows the extent of imbalance and ruin in the administration of the state as a result of random appointments and party booty and nepotism, and a large proportion of retirement salaries that go to non-Iraqi citizens.

Form (1)

Form (2)

Recent statistics from the World Bank indicate that poverty in Iraq has reached the following:

– 41.2% in liberated areas.

– 30% in the southern regions.

– 23% in the middle.

– 12.5% in the Kurdistan region

– The phenomenon of child poverty in Iraq, where it constitutes 48% of the population , their age under the age of 18 years, including 23% poor, each child of four children is classified poor.

– 5% the percentage of poor children in the Kurdistan Region.

– 50% the percentage of poor children in the southern governorates.

The economic expert, Obeid Freih stresses that the law of the general budget since 2004 until today is fraught with some problems, including:

1- The budget law did not approach to the scientific and international criteria for planning budgets.

2 – There is no concept in the legal and financial literature (not to issue the budget), but we are in front of two cases, not the third, first: the ratification of the budget by voting, and this follows the issuance of the budget law, the other: the rejection of the budget, also by voting , and this naturally caused the failure to issue the budget law.

The delayed issuance of the budget law without its explicit refusal to vote against it, is a heresy and a violation of the Constitution and the Financial Management Law.

3. The disbursement by 1/12 is a legal procedure to be implemented in the event of delay in the issuance of the budget. The Minister of Finance shall issue a circular to the Ministries of the State for disbursement of 1/12 of the expenses of the previous year and for continuing expenditures and on limited conditions , however this situation does not exceed days or weeks, not to mention the months or the year, the exchange in this case will be for continuing expenses only.

4. The rejection of the budget means rejecting the government’s program for that year because the budget is a digital translation of the government plan during the year, which includes (programs, objectives and activities)

5 – This budget is weak and inflexible, and the space of maneuver in which very little and it is not more than 10-20%, because the large proportion of about 44% is allocated to salaries and this ratio is not flexible, that can not be manipulated, of course. The remains are allocated for debt repayment first, then military obligations, which is less flexible.

Of the 2018 budget observations:

1- The budget is missing an important corner of it : the financial statement, which reflects the strategy on which the budget was based (the orientations of the government, its priorities, sources of revenues, fiscal policy, relative importance of each activity and sector) to provide information for everyone who acquainted the budget even from the non-specialists, and the ambiguous figures came lacking transparency and clarity.

2. The budget contains unclear articles, some of which are contrary to other articles or laws, and some of them are from other invalid years.

3 – Repeated phrase (an exception to the law of financial management and public debt) until it became a phenomenon, is it permissible to break the law whenever we want.

4 – There are articles that are repeated annually without application, without accountability, which weakens the law and loose its prestige

5 – There are articles that deal with cases with their own fixed laws, which leads to severe confusion, and perhaps conflict in the implementation (such as the law of retirement or civil service law or salaries, etc.) This is a mistake, because the budget law is annually,.

6 – The reliance on non-oil resources in this budget is very modest, despite all the risks to oil prices, and the global trend towards clean energy sources. As we have only found more figures than in previous years without any reference to measures to raise the level of contribution of non-oil resources.

7 – Dependence on accounting estimates represents an old settlement in 2015 led to the emergence of revenue in the budget accounts. It is really not income, meaning that there are no real increases in financial revenue.

8 – The weakness of public tax revenues, all its revenues do not exceed 790 billion, while revenues of the Telecom tax alone amounted to 740 billion.

9 – The weakness of tourism revenues, it is known that tourism in the whole world is taken from tourists, but in Iraq , it gives them instead of taking from them.

10. In Iraq, there is no database of State real estate, although publicly exploited by non-governmental organizations, and their revenues are due to those entities. In this regard, we propose to offer them to the public investment (in the health and medical education sectors.

Economic Studies Unit

Rawabet Center for Research and Strategic Studies