Iraqi Central Bank operates according to an important strategy in monetary policy , which depends on two factors: First: motivate banks to move towards the market and the provision of credit and banking finance required by the case targeting gross domestic product and addressing aspects of unemployment and economic stagnation; which requires lifting the financial depth of the country.

Second: continue to address inflation and targeting it through price signals adopted by the central bank to target inflation, and to achieve a unified framework of desired economic stability and growth.

The Governor of the Central Bank of Iraq , Ali Mohsen Ismail al-Allaq has been characterized in his work by taking reform, administrative and executive steps thoughtfully and calm; which reflected positively on the Bank ‘s management and its work in implementing monetary policy in Iraq, which aims to achieve the sustainability of price stability, achieving an acceptable level of monetary and economic stability and avoid changes affecting the value of national currency internally and externally, which arise due to changes in the general price level.

The monetary policy is facing currently a challenge of the decline in dollar sales from the Ministry of Finance ( as a result of the low price or oil production) to a level less than the market needs, high demand for foreign currency, with the inflexibility of government spending to fall to a level commensurate with the decline in revenue from foreign currency through the control of the value of money supply in the market, affecting the overall volume of demand and that change the money supply in the market.

So it is very important to pay attention and control of the growth of money supply, so many of the money supply will lead to higher inflation to levels that could harm the economy, either a little of it, it could impede economic growth, so the decision – makers in the Central Bank of Iraq aspire to achieve a balance between growth and inflation through restrictive or accommodative monetary policy.

Bank controls the restrictive monetary policy when it wants to reduce the money supply; while accommodative policy is used when aspires to increase the money supply, as a control of the money supply is done by interest rates or changing the minimum of the requirements of bank reserve.

And the restrictive monetary policy has a positive effect on the currency because higher interest rates will attract new capital added to the economy, because high interest rates are usually an indication of a strong economy and investors get the highest return on capital that they own in the banks within this economy.

The accommodative monetary policy has a negative impact on the currency, because making capital available easily is likely to lead to the problems of inflation, which reduces the purchasing power of the currency, and makes them less valuable, because low interest rates mean that investors are getting less return in exchange for capital they own within this economy, and investors will go to invest their capital in other places, which will contribute to the devaluation of the currency.

Or by the way of restricting the amount of money that can be used by the bank to lend to consumers and businesses, and this is done by determining the minimum reserve for banks.

And in front of it, the central bank to avoid resorting to policies that will impact on the overall stability of prices and exchange rates and economic growth , and therefore did not resort to the following options:

* reduced sales of foreign currency because it leads to a rise of the value of foreign currency, which would hurt the citizens, and directly affect creditors and investors

* continue to respond to the demand for foreign currency as covered by the (exchange rate stability, low foreign reserves).

* Floating exchange rate is currently not possible in Iraq because the dollar source is monopolized from the government by virtue of the nature of the economy and the resources of the state.

The central bank believes that the face of these challenges calls for a reduction of demand for the dollar by the impact on the causes of demand (security and political stability, control of imports, stimulate the real economic sectors, providing a safe environment), not by restricting the supply or procedures.

The central bank was able , despite all the challenges to achieve the most important goals of:

price stability and curb inflation: by continuing to reduce the inflation rate and reach down to the level of less than 2%, which represents the lowest level we reach it for many years. This means to stabilize prices at a certain level, the concerns of monetary policy makers have focused on eliminating inflation in prices, so as to eliminate the economic and social spending of the inflation so the achievement of price in the price level has become the primary objective of monetary policy and the vision of the Iraqi Central Bank, which sought to achieve it in the most difficult circumstances.

Curb inflation is a necessity as it leads to a state of uncertainty and confidence in the economy, affecting the low of the rate of economic growth.

The stability of the exchange rate of the local currency

—————————————————————–

The stability of the exchange rate of the local currency is done by achieving an acceptable level of monetary and economic stability, and to move away from the effects in the value of national currency that arise through changes in the overall level.

Stimulate economic growth: in all the different sectors which achieves in turn , an increase in the size of the national income and GDP growth; when monetary policy succeed in achieve economic stability and boost production when increasing the money supply in the market in the event of a recession, or is reducing the amount of money in the market in the case of inflation, then so have contributed to economic growth rates , especially in sectors that were experiencing instability which leads to raise investment rates.

Support financial stability at the level of sustainability of public finances of the state and the banking sector :

Expert see as to achieve stability in the financial market through the workof financial markets, the instability in that market can affect the state of the economy in terms of its stability and its ability to control to transfer of capital between the financial market and savings of people, and so on the ground that this market is an investment market, and stability affect the aspect of protection of investment and its growth , which leads us to say that whenever this market was stable , it was an indication of the success of the central bank to control the management of monetary policy , and then the Bank achieves the stability of financial market , which is one of objectives of a monetary policy that the Central Bank of Iraq seeks to achieve it.

The achievements are reflected in the framework of those goals to achieve the following:

Cover imports of private and public sector in foreign currency.

Thus it was preserved the purchasing power of citizens who their income was represented by what they earn mostly of salaries, government pensions, and depend to cover their needs from imports most of what they consume or use it, and preserving the rights of creditors or investors who were hit by the inflation causing them significant losses.

The stability of the exchange rate of the local currency:

………………………………………………………..

Despite the significant decline in revenues ( the dollar) from the source of oil, which reached about 70% in some months, an exchange rate of the dinar remained fixed and no significant gaps were occurred between the official exchange rate and the parallel market .

In the year 2016. the criteria was made (with the help of an international auditing office) to enter the banks and companies to the window to buy the dollar in order to control the operations of the sale of dollar and to maintain the exchange rate on the one hand and the consolidation of compliance with the rules of compliance and anti – money laundering and the financing of terrorism , on the other hand, those standards led to improve the practice of banks in this regard and building of organizational, and technical units and capabilities and technology to strengthen their internal rules and control, and maintain the level of adequacy of international reserves in accordance with international standards in the efficiency measure, and supports this level to maintain the exchange rate and meet the demand for the dollar.

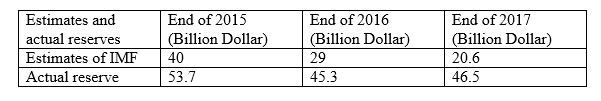

The estimates of International Monetary Fund (IMF) for reserves in March 2015 while the actual reserves as in the table below:

This is an indication of the success of the Central Bank of Iraq in achieving a balance between maintaining the level of the adequacy of the reserves and meet the demand for the dollar, in light of the sharp decline in revenues from Iraqi oil source ( as a result of the decline in world oil prices).

According to the agreement with the IMF signed by Iraq in 2008, it canceled all restrictions on foreign exchange operations.

Stimulating economic growth

in order to move the processes of development and support it under recessionary conditions, as a result of reduced government expenditures and increasing unemployment under the complicated security and social conditions , the Central Bank has taken the following initiatives: –

• support for real activities, lending projects of private sector of specialized banks, 5 trillion Iraqi dinars to the Bank of (agricultural and industrial, and housing fund, and real estate) , the biggest lending initiative on Iraq, and it has been allocated 1.5 trillion Iraqi dinars for private banks to support small and micro – enterprises, with the bank ‘s readiness to expand this initiative, as it has founded a competent organizational unit with Microfinance .

• Bank initiative to pay off the dues of contractors and suppliers and farmers (more than 5 trillion dinars), which hurt the activity of the private sector and the banking sector , where the government agreed to issue bonds proposed , organized , and prepared and disbursed by central bank in coordination with government banks.

• Support for financial stability at the level of financial sustainability and stability of the banking sector; to cope with the sharp decline in government revenues and the emergence of the features of a major financial crisis under special circumstances facing the country and the difficulty of adapting to the emergency and the sharp decline in oil prices, and the central bank supported the stability and fiscal sustainability and the prevention of risks it could result from the financial crisis ( government revenues in some months reached in 2016 to below 50% of cover salaries); and the central bank played a major role in containing the crisis by the purchase of treasury transfers (issued by the Ministry of Finance) amounting to 16 trillion dinars during the years 2015 201 6.

– allowing banks to buy treasury remittances using 50% of the mandatory reserves of banks held by the Central Bank noting that the purchased remittances from these amounts amounted to more than 4 trillion Iraqi dinars.

– The Central Bank has provided support to the government by indirect funding to the budget, and the ability to pay dues of international oil companies for the sustainability of oil production and export, and stumbling in the repayment constitutes a serious threat to the state ‘s resources, and the Central Bank of Iraq led a pivotal role in the (standby credit program) with the Fund international Monetary since 2015 , under which Iraq received soft loans and facilities at about $ 15 billion.

– fulfill the obligations of the bank to the requirements contained in the program document (standby credit UNDP), including maintaining the general level of prices and tackle inflation and maintain the system of exchange rate , and the reserves and to strengthen the systems of supervision of banks and financial institutions , and strengthen governance and audit based on the risk in the central bank to strengthen the systems of supervision and rules of regulations of the commitment on combating money laundering and the financing of terrorism and the lifting of restrictions on foreign exchange, regulatory and legislative amendments, including the amendment of the Central Bank Act and the obligation to audit the accounts and reserves and other activities of international auditing firms .

– Support for the deficit of general budget with amounts proposed by the Fund through the purchase of the Central Bank of treasury remittances, without which the budget can not be built, and therefore the Fund program stops.

-Support and contributing to achieve the terms of the agreement with the IMF in the framework of the reform of economic and financial policy and building rules and new policies to rebuild the state budget in order to cope with financial crises and control of public expenditure and to maximize local revenues and provisions to control the public debt and the development of financial indicators and targets related to the development of specific ceilings deficit and public debt and expenses within the gross domestic product measure, and to invite the Central Bank and the Ministry of Finance to set up one account to the public treasury rather than an account for each exchange of government units in order to achieve the existing cash management and control of it and get rid of the dispersion of Cash and take advantage of the non moveable money ; where the central bank diagnosed the presence of large amounts (trillions) dispersed in the sub – accounts that are not used within the government ‘s priorities and needs, which leads the Ministry of Finance to borrow at the time that can guide the availability of these accounts and use it .

– Coordination with the Ministry of Finance on the diversification of public debt sources , both internally and externally, including the issuance of local bonds to the public (for the first time) in order to diversify to meet the deficit on the one hand, and the deepening of the financial market and the introduction of new tools in it, and during the 2016 , a permanent joint coordination committee was formed between the Central Bank and Ministry of Finance for the coordination between fiscal and monetary policies.

As part of the stability of the banking sector under the shadow of the financial crisis and leave it from the direct and indirect effects on the banking sector and thus on the overall financial stability, central bank acts to reduce these effects through the following:

• To conduct a survey and comprehensive review of the situations of banks and define banks facing special difficulties in liquidity and set a program and urgent measures to address them and the conditions of vast majority of them were pulled out to promote financial stability in the banks and avoid the risks of suspicious transactions, and was obliging all banks to comply with the law against money laundering and terrorism financing No. 39 of 2015 and the regulations and rules associated with it, including the establishment of specialized units within the banks concerned with operations against money laundering and risk management and compliance.

• The central bank cut historically important strides during the years 2015 and 2016 to promote and strengthen the procedures and regulations related to that which has received praise and support from relevant international organizations, including the Financial Action Organization (FATF).

• Establish Unit (Financial Stability) and (risk management) to reduce systemic risk and to take precautionary measures at both partial and overhaul levels supported by early warning systems and the face of crises and achieve financial stability through the development of mathematical models to determine the financial system’s ability to absorb crises and implement stress tests periodically.

• Protecting the banking sector from credit risk by building a broad and integrated program that provides a modern and sophisticated database available to all banks to inquire about the borrowers to make appropriate decisions on borrowers in order to ensure and the stability of the financial system and it has been strengthened the overall control systems based on the risk in accordance with the best international standards and practices of the Basel Committee for financial supervision.

• Strengthening the governance system in the banking sector and the issuance of the first guide for corporate governance in the banking sector includes the principles, concepts and rules of governance, according to the latest international developments and practices to promote the proper performance of the banks and to protect shareholders and stakeholders and provide a sound framework for the management of banks separating the ownership and management and provide a suitable framework for disclosure and transparency and control.

• Enhance financial stability by the support and stimulate the central bank to establish Islamic banks to the advantage of its Islamic finance of security against Vibrations of the market and to the achievements that attract savings that do not deal with traditional commercial banks and thus capital market development is realized , the central bank could stimulate more than half of the money transfer companies for turning to Islamic banks and thus achieved two goals , the first is to support the industry of Islamic banking and expanding it , and the other to limit of remittance companies that the central bank aims to get rid of them for objective justification.

– reducing the risk to customers in financial transactions through the development of a comprehensive framework of policies and measures to be taken in the regulatory and supervisory, legislative and awareness – raising and educational dimensions and an organizational unit has been set to undertake these tasks

– The completion of the legal, regulatory and financial measures to establish an institution to guarantee deposits and will operate soon; in order to attract the public funds and to enhance confidence in the banking system.

– In order to develop the financial markets, so as to enhance financial depth and thus support the financial stability , the Central Bank developed procedures of the process of settling the results of trading in the financial market through payment systems and the use of the purchase and the sale system of paper securities and to develop effective mechanisms to strengthen the central depository and settlement systems and work to reconcile the settlement system of the operations of Securities trading with payments systems .

The functions and tasks developed for the Central Bank of Iraq, after 2014 is to focus on:

…………………………………………………………………………………………

The overall quality: which means continuous development of administrative processes to be reviewed and analyzed and the search for ways and means to increase performance and reduce the time to complete it by cutting out all the tasks and functions that are useless and unnecessary for the client or process; to reduce the cost and raise the level of quality based in all stages of development on the requirements and needs of the client.

Financial Stability: the Central Bank of Iraq participated actively in the strengthening of the banking sector ‘s performance based on the best international practices to expand its activities and the development of its services, thereby enhancing the stability of the financial sector in Iraq as the largest of its components and the most vulnerable to the risks because of the nature of the work of banks in bearing the risks of financial intermediation and the implementation of the settlement operations of payments, the Central Bank of Iraq focused on continuous communication with the banking system units and create conditions to ensure the creation of banking environment to support the monetary stability, and creation the effective, national and developed system of payments and finding effective national policy and a sophisticated system, in addition to the duties, functions and powers Enjoyed by the central bank and its permanent ability to intervene in the institutions of the system through what it has been owned of cash and control tools.

Financial inclusion, the Central Bank of Iraq is interested in the social aspect in terms of the greatest concern for the poor and low – income people, paying particular attention to women and access to individuals and small and medium – sized and micro – enterprises, and the public interest that relate to the creation of opportunities for the customer , which contributes to economic growth and reduce poverty and improve the distribution of income, and raise the standard of living, and the provision of financial services in easy and simple ways and at the lowest cost (such as payment via mobile phone).

Central Bank ‘s role in promoting financial inclusion:

– the development of rules and regulations aimed at facilitating the procedures of banking transactions in all forms and approval of the availability of simplified financial services such as mobile phone use in electronic payment and other financial operations, and highlight the role of credit information and the development of payment systems, and stimulate the financial sector, especially banks to spread financial culture, and increasing the number of ATMs and any other means that will expand the network availability of banking services.

– Work on the establishment of comprehensive databases of the records include historical credit data for individuals, small and medium – sized companies and in addition to the database that records the transferred assets.

Audit based on risk: means the activity of internal audit and control the quality, and follow – up matters included in the internal audit reports with management and make sure to put corrective plans.

microfinance: where the government is attempting to implement important political reforms while continuing military operations against al – Daesh, here microfinance becomes – in the broadest sense, which includes loans, savings, payments and insurance for low-income families and small businesses – one of the procedures that can encourage local economic activity and help people to manage what they face of setbacks, or economic shocks due to the difficult situation in the country.

Financial risk management: is the relationship between the required return on investment and the risks associated with this investment, in order to employ this relationship so as to maximize the value of the investment from the point of view of his companions also can be defined as events management that can not be predicted to develop a strategy, including appropriate policies and procedures for it and constantly updated.

Prudential supervision: defined as policy through which to identify and monitor and control systemic risk to reduce the accumulation of it and strengthening of the financial system’s ability to withstand shocks using a set of tools based on a set of basic indicators, the systemic risk means: the risk of developments that threaten the financial stability of the system and therefore the economy fully.

Anti – money laundering and the financing of terrorism: Iraq achieved a significant progress over the past two years in the prevention of money laundering and terrorist financing through the issuance of a special law No. 39 of 2015, this law regulated substantially the transfer of money and the fight against money laundering, and established special office separated from the Central Bank administratively and financially to receive notifications on the operations of suspicion. ”

The “Association of Banks” to hold intensive sessions regarding the fight against money laundering , where more than one hundred trainees have been graduated since the beginning of 2017 and the “Central Bank of Iraq launched ” the financing of small and medium enterprises program after the allocation of a trillion Iraqi dinars for private banks, adding that it was not possible to finance these projects at the level of ambition where there were a lot of obstacles inside and outside the bank, the most notably the government institutions that refuse to provide private banks to bail for their employees.

Electronic payment: it means a group of methods and procedures and rules for the transfer of money between the participants within the system that have to move funds through the infrastructure of payment systems.

Protect customers: They are all laws, judicial decisions, which aims to provide protection to consumers from exposure to any of the fraud operations they may encounter by some traders, also is defined as group of social and ethical controls imposed on all workers in the commercial sectors, and requiring them to respect all categories of consumers and the provision of goods and services to them properly and in an appropriate manner.

Compliance: an independent function, it has been approved under the Banking Act No. 94 of 2004, it is working to confirm the bank ‘s commitment in its daily banking operations to the laws and regulations issued by the Central Bank and Finance Authority, as well as policies and procedures and regulations , accounting standards and the requirements of the Basel Committee and the Law on Public Enterprises and the Law on Combating money laundering and instructions issued according to it and the legal and standard ratios defined for the operations of credit or investment and the legal reserve and others, for the purpose of ascertaining the validity of the procedures and avoid everything that would expose the bank to various risks.

The Economic Unit

Rawabet Center for Research and Strategic studies