By Shatha Kalel

Iraq enters 2026 at a critical economic crossroads. Despite consistent oil revenues and ongoing reconstruction efforts, the economy faces deep structural weaknesses that threaten long-term stability. Understanding these pressures helps explain why 2026 will be a decisive year for Iraq’s growth, its financial system, and the livelihoods of millions of citizens.

1. Heavy Dependence on Oil Revenue

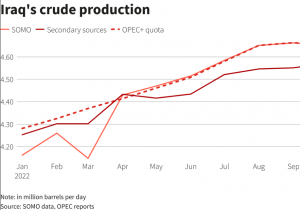

Oil remains the backbone of Iraq’s economy, accounting for more than 90 percent of government income. In 2025, global oil prices fluctuated due to geopolitical tensions, OPEC+ production constraints, and weakening global demand. These factors illustrate a major vulnerability: Iraq’s budget rises or collapses depending on decisions made outside its borders.

In 2026, oil demand is expected to grow slowly as the global economy cools. Analysts predict moderate prices rather than high spikes, meaning Iraq cannot rely on sudden revenue increases. This pushes the government to reconsider public spending, reduce deficits, and accelerate diversification into agriculture, manufacturing, and renewable energy.

2. Currency Stability and Banking Reform

The dinar’s stability has been a central topic since the tightening of international compliance rules in 2023–2025. These rules restricted dollar flows, exposing weaknesses in Iraq’s banking sector. In 2025, the Central Bank of Iraq (CBI) increased digital oversight, improved know-your-customer measures, and sought to modernize banking operations.

By 2026, further stabilization is expected as the CBI continues to digitize transfers and integrate more banks into global financial systems. Yet the challenge remains significant. Without trust in banks and a reduction in cash-based transactions, foreign investors will remain cautious.

3. Private Sector Challenges

The private sector still struggles to compete with Iraq’s oversized public sector, which employs millions but contributes limited economic productivity. In 2026, reforms must focus on reducing bureaucratic barriers, offering tax incentives, and strengthening laws that protect investors and small businesses.

Youth unemployment remains especially high. More than half of Iraq’s population is under 25, creating pressure on the government to provide jobs or support entrepreneurship. Any failure to address youth employment could worsen social tensions and migration trends.

4. Foreign Investment and Reconstruction

Reconstruction across Baghdad, Basra, Nineveh, and Anbar has generated economic activity. Partnerships with Gulf countries have increased, especially in energy, clean electricity, and transportation corridors.

For 2026, the most promising opportunities include:

Gas field development to reduce dependence on imports

Expansion of solar energy projects

Logistics corridors linking Iraq to Jordan, Saudi Arabia, and Turkey

Housing and urban expansion projects for Iraq’s rapidly growing cities

However, corruption and administrative delay still limit foreign confidence. If reforms improve transparency, Iraq could attract billions in additional investment in the next two years.

5. Water Scarcity and Agricultural Decline

Water levels in the Tigris and Euphrates continue to drop, hurting domestic food production. Climate change, reduced rainfall, and upstream dams in Turkey and Iran have intensified the crisis.

In 2026, Iraq must implement:

Modern irrigation systems

Crop diversification

Water-saving technologies

Strong negotiations on transboundary water rights

Failure to act risks food price inflation, rural displacement, and deeper poverty in agricultural regions.

6. Outlook for 2026: A Year of Transition

Iraq’s economic outlook for 2026 is mixed. Modest oil prices will keep revenue stable but not strong. Banking reforms will gradually restore trust. Reconstruction and Gulf partnerships will provide momentum, yet political instability and bureaucracy may slow progress.

Expected outcomes for 2026:

GDP growth around 2.5–3.2 percent

Inflation remaining moderate if currency remains stable

Oil production expected to be steady under OPEC+ limits

Foreign investment slowly increasing with reforms

Unemployment remaining high unless private sector reforms accelerate

Iraq has the potential to build a more diversified, resilient, and modern economy, but achieving this vision in 2026 will require political commitment, stronger institutions, and sustained reform. The coming year will test whether Iraq can move beyond its heavy dependence on oil and build a more secure economic future for its people.

Economic Studies Unit / North America Office

Al-Rabetat Center for Research and Strategic Studies