BY: Shatha Kalel

Gold prices have been on a rising trend for over two decades, with total demand hitting record levels last year. The forecast for 2024 indicates yet another record year for gold. Recent interest rate changes have caused short-term upward pressure on gold, while long-term shifts, including BRICS countries using gold for international exchange and central bank interest cuts, have solidified gold’s standing as a robust investment. As gold prices soar, gold mining stocks present a lucrative opportunity for investors.

Central Bank Influence

A recent survey by the World Gold Council (WGC) involving 70 central banks reveals that no banks expect a decline in gold purchases, with 81% anticipating an increase. Nearly a third of these banks plan to buy gold in the next 12 months. Central bank gold purchases have significantly influenced the market in recent years, effectively ushering in a new gold standard.

This trend is mirrored in the reserve policies of central banks, with gold already surpassing the euro in global reserve shares. Banks continue to raise their gold price forecasts, with UBS expecting gold to reach $2,800 per ounce by the end of next year and Bank of America forecasting $3,000 within the next 12-18 months.

Investment Opportunities in Gold Stocks

Investing in companies that produce gold is currently one of the best strategies. Among these, Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) stands out. The company’s location, management team, and strategic outlook indicate massive growth potential. Over the past 12 months, Bedford Metals has achieved a staggering return of 4,340%.

With a new gold supercycle on the horizon, gold stocks like Bedford Metals are poised to become the new growth stocks. This Canadian mineral exploration company specializes in developing gold deposits in British Columbia, a region known for its significant gold reserves and favorable mining conditions. Bedford’s stock has already surged by 344% since the start of the year and 4,340% over the past twelve months, yet it remains affordable with ample growth potential in 2024.

Central-Bank Buying and Market Volatility

Gold is widely regarded as a safe-haven asset, and long-term global trends are now causing it to grow like a growth stock. Central banks’ concerns about the value of their currencies and the security of their trade have prompted them to buy gold, driving up its price by over 20% in the past year. In May, gold reached an all-time high of $2,450 per ounce.

Unlike stocks or bonds, gold typically moves independently of other asset classes, offering valuable diversification benefits. It performs best during market volatility, serving as a stabilizing force when other investments decline. In 2023, gold accounted for 18% of global reserves, surpassing the euro’s 16%. The U.S. dollar’s share of total reserves dropped to 48% amid waning trust in fiat currencies due to asset bubbles, escalating conflicts, and inflation fears.

Gold in Technology

Gold’s importance extends beyond being a store of wealth. It is a major component in Nvidia’s (NASDAQ: NVDA) products, enhancing the conductivity of its chips, which are crucial for AI and machine learning. The electronic device you are using likely contains gold, highlighting its widespread use in technology.

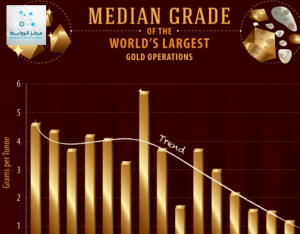

The Outlook for Gold and Gold Stocks

Rising gold prices are expected to lead to record-breaking gold-mining profits in Q2 2024, creating a bullish outlook for gold stocks. Historical data shows that gold typically experiences a seasonal rise starting in July and continuing through the latter half of the year. As more traders recognize gold’s potential, they will likely invest in gold stocks during the summer to capitalize on its growth.

Bedford Metals exemplifies this trend. The company’s strategic decisions have positioned it to benefit from increasing global gold demand and record-breaking prices. The recent bull market for gold underscores the metal’s insufficient supply to meet economic demands. Growth stocks like Bedford Metals will continue to thrive by addressing these supply constraints, offering early investors substantial returns.

Conclusion

The gold market is experiencing a robust bull run driven by central bank purchases and favorable economic conditions. Gold mining stocks, particularly those like Bedford Metals, provide a promising investment opportunity with their strong growth potential and strategic positioning. As global demand for gold continues to rise, investors in gold stocks are likely to see significant returns, making now an opportune time to invest in this sector.